You do not need a lottery ticket or a viral startup to build serious wealth. Most people who grow their net worth steadily are not financial geniuses. They just repeat small, boring habits and do it long enough for time to do the heavy lifting.

Compounding turns consistency into momentum. The earlier you start, the more dramatic that momentum becomes.

Why Net Worth Compounding Favors the Consistent

Net worth compounding is less about dramatic wins and more about steady inputs. A $200 monthly contribution invested for 25 years at a modest return can grow into six figures, while the same total amount invested sporadically often falls short.

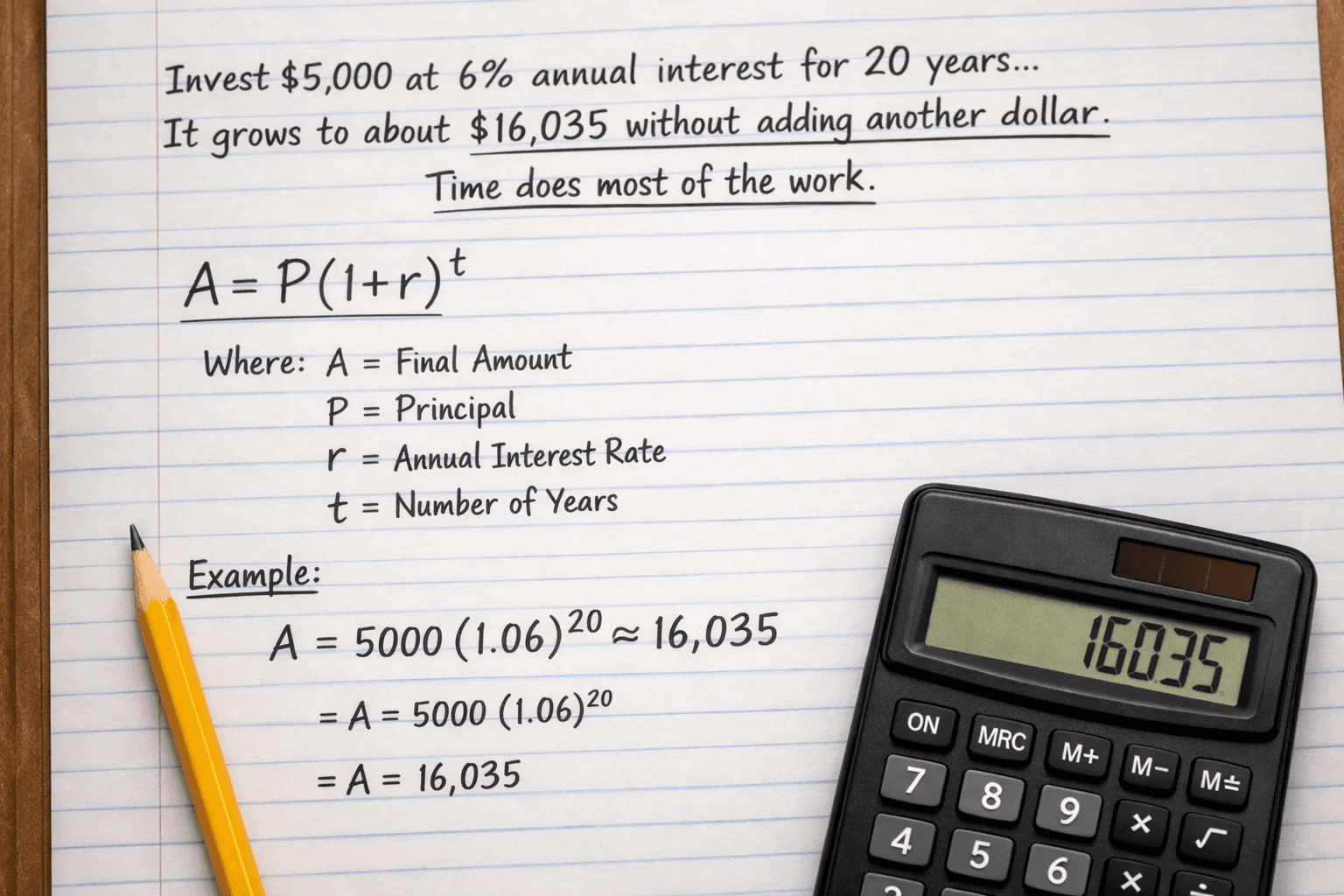

The math is simple but powerful. Returns generate their own returns, and those returns keep stacking year after year.

Time becomes your biggest asset. Miss a few early years, and you lose not just the money you could have invested, but the growth that money would have produced.

Lever One Steady Saving That Builds Momentum

Saving is the seed. Without it, investing and debt reduction stall before they begin.

Automating transfers into a high-yield savings account or CD creates consistency without daily willpower. Credit funds too.

Interest stacks over time in a protected compound interest account, and understanding how compounding works can clarify why even modest balances grow. But the rate depends on which accounts you choose and how early you start.

Small upgrades help too.

Try:

- Increasing your savings rate by 1 percent each year

- Redirecting raises or bonuses straight into savings

- Negotiating one recurring bill and banking the difference

- Setting a weekly calendar reminder to review balances

Each action feels minor. Yet over a decade, they reshape your balance sheet.

Lever Two Disciplined Investing and Reinvesting

Saving protects cash. Investing multiplies it, enough to enjoy a happy life in your gray years and even keep your survivors taken care of.

Reinvested dividends and regular contributions keep the flywheel spinning. Missing a few market swings matters less than staying invested long enough for growth to compound.

And as surveys show, many Americans worry about retirement income. In fact, according to Bankrate’s retirement savings report, a significant share of workers (72 percent) doubt Social Security will fully support them. That means your investments may need to carry more of the load, so consistency matters to you directly.

When you automate contributions and rebalance annually, you are quietly supercharging your investment strategy without chasing trends.

Lever Three Strategic Debt Reduction

High-interest debt works against compounding. A credit card charging 20 percent interest compounds in reverse, shrinking your net worth every month.

Paying off that balance delivers a guaranteed return equal to the interest rate. Few investments offer that kind of certainty.

The Snowball and the One Third Rule

The debt snowball method focuses on clearing smaller balances first for psychological wins. Momentum builds quickly when you see accounts disappear.

A 2025 paper on the one-third financial rule published in the Journal of Risk and Financial Management (arXiv) explores allocating income across spending, saving, and debt repayment for long-term stability. Structured allocation reduces decision fatigue and keeps progress steady.

Refinancing and Rate Negotiation

Refinancing student loans or consolidating credit card debt can lower interest costs. Even a small rate drop shifts more of your payment toward principal.

Calling a lender to request a lower rate feels uncomfortable. Saving thousands in interest over time feels better.

The 30-Day Net Worth Reset Plan

Momentum loves a clear starting line. A focused 30-day reset can jumpstart net worth compounding.

Here is a simple framework you could follow:

- Week one: calculate your net worth and list all debts

- Week two: automate savings and investment contributions

- Week three: negotiate at least one recurring bill or rate

- Week four: choose one debt to attack aggressively

Track your net worth at the same time each year. Watching it rise, even slowly, reinforces the habit loop.

Big Wins Versus Small Repeated Actions

A $10,000 windfall invested once is helpful. But ten years of consistent $300 monthly investments? That can be transformational.

Sporadic effort creates spikes while repeated action creates curves that bend upward over time.

Compounding rewards patience and punishes inconsistency.

Make Net Worth Compounding Your Default Setting

You do not need perfect timing. You need repetition. Set the systems once, then let net worth compounding work quietly in the background.

If you found this topic inspiring, explore related topics on our blog, or reach out to Empower for more Investment Insights.