Compared to other areas of personal finance, decisions can feel more complex when it comes to financial protection. The reason is simple: these decisions involve planning for situations people hope won’t happen yet want to be prepared for in case they do occur.

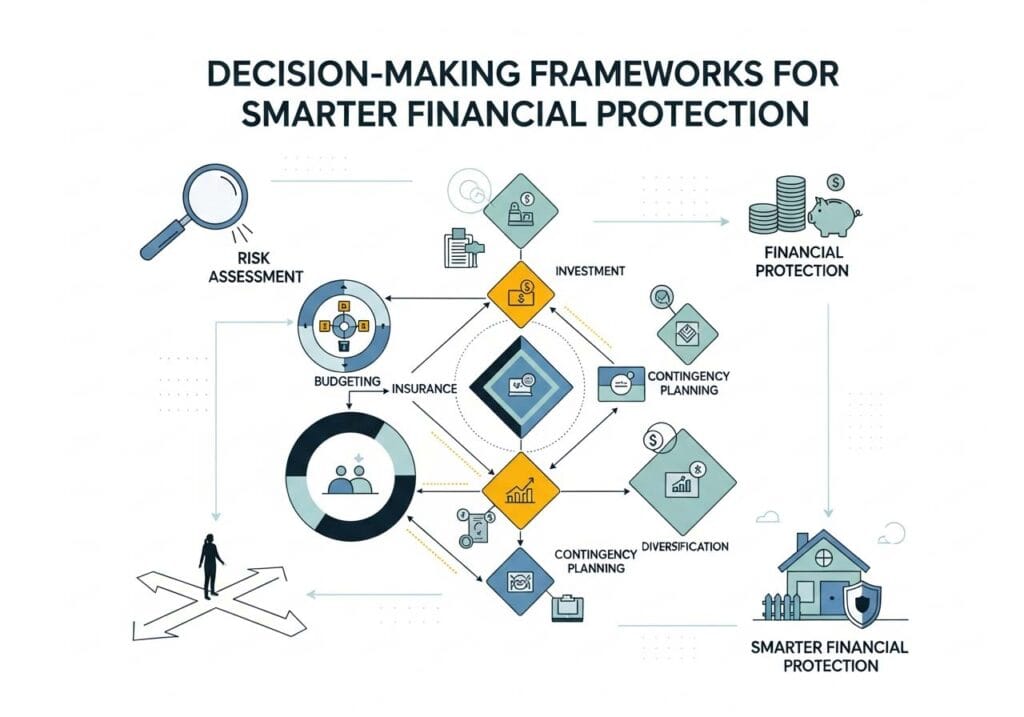

The good news: using a clear decision-making framework can bring structure to the process. It can turn uncertainty into informed consideration rather than hesitation. While they don’t remove risk, frameworks allow people to better explore choices and feel more confident about the protection they put in place.

Start with Purpose, Not Products

Any strong framework begins by identifying purpose. Don’t look at policies or providers just yet. At this stage, it’s valuable to see what protection is meant to achieve. For instance, this could involve covering specific costs, or it might be about reducing financial strain on loved ones.

When taking this step, you should concentrate on outcomes rather than products. In doing so, it prevents unnecessary complexity from the start and keeps decisions grounded in real needs.

Use Consistent Criteria to Compare Options

Once purpose is clear, the next move is to apply consistent criteria to make comparisons more meaningful. You don’t want to switch focus with each choice. The goal is to use the same measures across providers to highlight genuine differences.

Common criteria include:

- Affordability and long-term manageability

- Provider reputation and genuine independent ratings

- Clarity of terms and policy structure

- Customer experience and accessibility of support

- Flexibility to adapt as circumstances change

By using these, it supports consistently clearer, more confident evaluation.

Incorporate Trusted Comparison Tools

Never underestimate how valuable comparison tools can be within a decision-making framework. These tools bring together information that, under other circumstances, would require significant time to gather independently. When utilised thoughtfully, they support insight rather than replacing judgment.

When the aim is to find the best life insurance providers, Reassured is one example of a comparison service people use. This platform presents the likes of independent ratings, provider data, and clear explanations in one place. With comparison services, you can evaluate options more efficiently while retaining control over the decision.

Balance Information with Action

A framework needs to encourage progress. It’s not there to cause delays. While research is vital, there’s a stage where additional information stops adding value. Decision-making frameworks assist in identifying when comprehension is sufficient to move forward – even if certainty isn’t absolute.

This balance prevents over-researching and supports timely, confident action.

Review Decisions as Part of the Framework

Financial protection decisions are not fixed. A solid framework incorporates regular review, recognising needs and priorities change. Periodic check-ins ensure arrangements remain appropriate and matched with current circumstances.

Seeing review as part of the process, rather than a correction, supports long-term confidence and adaptability.

Conclusion: Frameworks Create Confidence Through Clarity

Decision-making frameworks don’t simplify financial protection by ignoring complexity. They organise the complexity. In doing so, you can approach financial protection with greater clarity.

In an area where reassurance matters, structured decision-making transforms uncertainty into informed confidence. In turn, it supports smarter, more sustainable financial protection choices over time.